Medicare Makeover: Key Changes and What They Mean for You

Medicare in 2024-2025: Here's What You Need to Know

As we look ahead to the coming years, Medicare continues to evolve, bringing important changes that beneficiaries should be aware of. Understanding medical cost changes is crucial for your comprehensive financial planning. The healthcare landscape is evolving, and these updates will have an impact on your coverage and out-of-pocket expenses. From adjustments in premiums to modifications in benefits, staying informed about these changes will help you make the most of your Medicare plans.

This updated article covers the key modifications for 2024 and 2025, focusing on cost increases, coverage expansions, and significant policy shifts.

Part A Changes

Medicare Part A, which covers inpatient hospital stays, skilled nursing facility care, and some home health care, is projected to see the following adjustments in 2025:

• The Part A deductible is projected to increase to approximately $1,680 in 2025, up about $48 from the 2024 amount of $1,632. This continues the trend of modest annual increases.

• For most beneficiaries, Part A premium remains free if you or your spouse paid Medicare taxes for at least 10 years (40 quarters) while working.

• Those who need to buy into Part A may see slight increases in their premiums for 2025. Projections suggest:

• For individuals with 30-39 quarters of Medicare-covered employment, the premium might increase to around $286 per month (up from $278 in 2024).

• For those with fewer than 30 quarters, the premium could rise to approximately $520 per month (up from $505 in 2024).

• Skilled nursing facility costs for 2025 are projected as follows:

• First 20 days: $0 (unchanged)

• Days 21-100: Approximately $210 per day (up from $204 in 2024)

• Beyond 100 days: All costs (unchanged)

Part B Updates

For Medicare Part B, covering outpatient care, preventive services, and medical supplies, the projected changes for 2025 are:

• The standard monthly premium is estimated to increase to about $185 in 2025, up from $174.70 in 2024. This projection assumes a 6% increase, in line with the cap on base premium growth implemented by the Inflation Reduction Act.

• The annual deductible is projected to rise to approximately $254 in 2025, up from $240 in 2024.

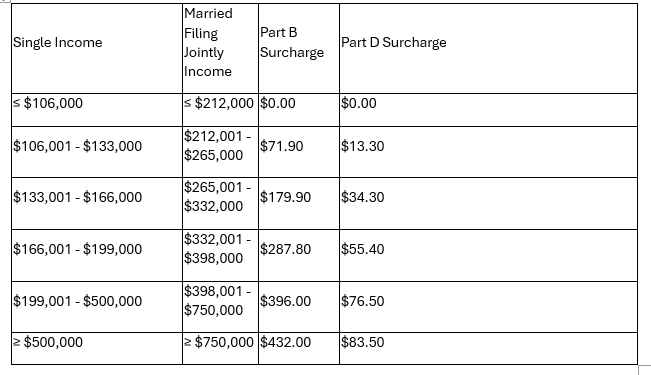

• Income-Related Monthly Adjustment Amounts (IRMAA) for 2025 are projected as follows:

Expanded Coverage for Chronic Pain and Mental Health

Starting in 2024, Medicare will offer enhanced coverage for chronic pain management and mental health services:

• Chronic pain management services will be covered for those experiencing symptoms for more than three months.

• Mental health coverage under Part B expanded to include family and marriage therapy.

• More intensive outpatient mental health services, known as partial hospitalization, will be covered at doctor's offices, hospitals, or community centers.

Telehealth Services: Changes on the Horizon

Telehealth coverage will undergo significant changes:

• Through 2024, Medicare will continue to cover telehealth services for all beneficiaries, allowing appointments from any location in the United States.

• Starting in 2025, telehealth coverage will be limited primarily to beneficiaries in rural areas.

• Mental healthcare will remain an exception, continuing to be available virtually for all beneficiaries.

Prescription Drug Coverage Improvements

Thanks to the Inflation Reduction Act, Part D will see substantial improvements:

• Monthly insulin copayments are now capped at $35.

• Beneficiaries reaching catastrophic coverage levels ($8,000 in 2024) will no longer be responsible for medication copayments for the rest of the year.

• Recommended vaccines will be available with nothing out-of-pocket, including those for shingles and whooping cough.

• The Extra Help program has been expanded for those below 150% of the federal poverty level.

Medicare Advantage (Part C)

While there are no federal changes specific to Medicare Advantage plans, it's crucial to review the offerings from private insurers, as benefits and costs can vary significantly between plans.

Key Medicare changes for 2025

• Out-of-pocket limit on drug costs: The yearly out-of-pocket drug costs will be capped at $2,000. Once this limit is reached, beneficiaries won't have to pay copayments or coinsurance for covered Part D drugs for the rest of the calendar year.

• Medicare Prescription Payment Plan: This new option allows beneficiaries to spread their out-of-pocket drug costs across the calendar year (January-December), helping to manage expenses without actually lowering drug costs.

• Elimination of the coverage gap: The "donut hole" will be eliminated, resulting in a three-phase benefit structure: deductible phase, initial coverage phase, and catastrophic phase.

• Manufacturer Discount Program: Replacing the Coverage Gap Discount Program, manufacturers will typically pay a 10% discount for brand-name drugs and biologics in the initial coverage phase, and a 20% discount in the catastrophic phase.

• Changes to reinsurance payments: The reinsurance payment amount for a Part D beneficiary will decrease from 80% to 20% for brand-name drugs and biologics, or 40% for generics, after exceeding the annual out-of-pocket threshold.

• Expanded accrual of out-of-pocket costs: More payments by third-party payers will count towards beneficiary out-of-pocket costs, potentially reducing overall beneficiary spending.

• Medicare Advantage plan notifications: Plans will be required to send policyholders a "Mid-Year Enrollee Notification of Unused Supplemental Benefits" in July, listing unused benefits, their scope, out-of-pocket costs, and instructions on how to access them.

• Changes to sales incentives: The Centers for Medicare & Medicaid Services (CMS) aims to end sales incentives for Medicare Advantage and Part D plans, implementing fixed compensation caps for brokers and agents to prevent steering beneficiaries towards plans that may not be in their best interest.

Part D Premiums for 2025

• The base beneficiary premium for 2025 is $36.78, an increase of $2.08 or 6% over the 2024 base premium of $34.70.

• The Inflation Reduction Act includes a provision to cap growth in the base beneficiary premium to 6%.

• Actual Part D plan premiums for 2025 will be announced in September 2024.

• CMS is implementing a new Part D Premium Stabilization Demonstration to help mitigate potential premium increases for stand-alone drug plans.

Conclusion: The Importance of Financial Life Planning and Income Management

Understanding these changes is crucial for effective retirement planning as Medicare continues to evolve. The complexities of healthcare costs, coverage options, and their impact on your overall financial picture underscore the importance of comprehensive financial guidance.

As a Certified Financial Planner, I cannot stress enough the value of integrating healthcare considerations into your broader financial strategy. Financial Life Planning can help you navigate these changes, optimize your coverage choices, and align your healthcare decisions with your unique retirement goals.

Moreover, it's crucial to actively manage your reportable income to avoid potential Part B and Part D surcharges. These Income-Related Monthly Adjustment Amounts (IRMAA) can significantly increase your Medicare costs if your income exceeds certain thresholds. Strategies such as careful timing of retirement account withdrawals, managing capital gains, and considering Roth conversions can help you maintain control over your reportable income and potentially avoid or minimize these surcharges.

Don't leave your healthcare and financial future to chance. Click the "Free Consultation" button now to explore how Financial Life Planning can assist you in creating a robust strategy that accounts for your evolving healthcare needs, manages your income effectively, and ensures a secure, comfortable retirement.

Remember, staying informed and proactive about your Medicare coverage and overall financial picture is an essential part of maintaining your financial health and peace of mind in retirement. Let's work together to build a plan that protects your health and your wealth, while optimizing your tax situation to avoid unnecessary Medicare surcharges.

Edward C. Goldstein, CFP®, MBA, President

CERTIFIED FINANCIAL PLANNER ™ Practitioner

Financial Life Planning, LLC

10,000 Lincoln Dr. East, Suite 201

Marlton, NJ 08053

Phone: 856-988-5480

Fax: 908-292-1040